Newsletters, Articles, Case Studies, and More!

Marketing Solutions for Financial Institutions

The Stellar Insights Blog was created to help educate banks and credit unions on marketing solutions that drive results. We primarily focus on Member Retention & Acquisition, Direct Auto Loan Refinancing, and Overdraft Protection.

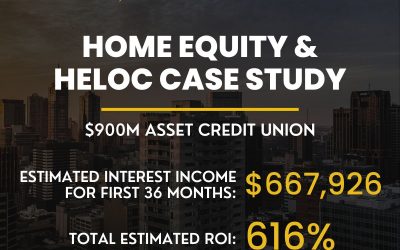

Home Equity/HELOC Case Study

Background This credit union (CU) is located in the Northeast and has an asset size of roughly $900M with 70,000+ members. The CU has a community charter footprint with a potential membership of several million households. Stellar Home Equity & HELOC Proposal Our...

Has the Auto–Refi Market Declined?

Interest Rates Have Increased We've all noticed that interest rates have risen over the past several months. The Fed isn’t done with rate increases, and this limits the number of prospects that qualify to refinance their vehicles. In some markets, available prospects...

Explore Our Stellar Loan Processing Option

We have the solutions to getting your auto loans processed in a timely manner. Vehicle values have risen substantially in recent years, leading to more opportunities to refinance your automobile. These increased opportunities have led to a rise in auto loan...

Fall 2022 Stellar Insights Introduction

Welcome to our Fall Edition of Stellar Insights. This time of the year is critical as we start to analyze year-to-date results, begin strategic planning for the upcoming year, and ultimately finalize budgets and plans. That being said, we felt it was crucial to...

Instant Profitability on New Members

Increase Revenue with Direct Lending. Most credit unions have multiple strategies to grow their membership base and spend hundreds of thousands of dollars annually to market to potential prospects. But what is the actual return on investment for acquiring new...

Loan Volume Down? Not for us!

Rate Increases Got Your Loan Volume Down? As interest rates increase and the mortgage market slows, many financial institutions are seeing a decrease in loan volume. Our Stellar Auto Loan Recapture Program continues to perform extremely well for our clients. Since...

Member Retention

Credit Union Members are Vulnerable A comprehensive growth strategy requires both an offensive and defensive approach. Member retention is essential to the financial growth and success of any credit union. Obtaining new members requires a lot of time, money, and...

The 6th Stellar Difference – Member Retention

Member Retention is Essential to Growth Think about how much it costs to secure a new member. Now think about how little time and money you dedicate to retaining them long-term. With the Stellar Financial Group's auto recapture program, an integral part of the...

The 5th Stellar Difference – Lead Exclusivity

Stellar Lead Exclusivity Unlike many of our competitors, The Stellar Financial Group offers both member and prospective member lead exclusivity. There is NO data overlap between clients. Each client’s confidential information is secured in separate silos. All...

The 4th Stellar Difference – Pricing

A Stellar Pricing Solution Let’s be honest, everything in business always comes down to the money. The difference here at The Stellar Financial Group is we don’t let money get in the way of a viable solution for our clients. Our success-based fee structure has a...

The 3rd Stellar Difference – Marketing Touch Points

Our Multi-Channel Marketing Strategy One of the Stellar Financial Group's strategic differences is our 7-Touch marketing approach to auto refinancing. While most companies mail a letter and wait for a response, we build your brand in multiple different ways. And by...

The 2nd Stellar Difference – Marketing & Branding

The 2nd Stellar Difference is Marketing & Branding. Unlike many of our competitors, all marketing support used in Stellar's Auto Loan Recapture Program is completely branded to your Financial Institution! Your institution can benefit from thousands of dollars in...

The 1st Stellar Difference – Customer Service

If you think all Auto Loan Recapture Programs are the same, we'd love to show you the Stellar Difference! In this video series, we'll show you what key aspects of our Auto Loan Recapture Program make it a Stellar Solution for any financial institution. Watch Stellar's...

Overview: Stellar’s Auto Loan Recapture Program

Today there are over 3 million loans (totaling over 90 billion) that qualify to be refinanced. This is your alternative solution to combat the reduction in mortgage applications. Turbo-Charge Direct Lending Stellar’s Auto Loan Recapture Program offers a turn-key...

Welcome to the Spring 2022 Edition of Stellar Insights

Welcome to the 2022 Spring Edition of Stellar Insights!Welcome to this special edition of Stellar Insights. We felt this would be an ideal time to review the auto loan recapture business in detail. There have been significant changes in the auto finance and refinance...

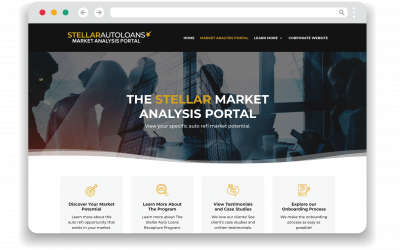

The Stellar Market Analysis Portal is HERE

Browse Our Product Solutions at Your Convenience We are very excited to launch The Stellar Market Analysis Portal. This virtual marketing site allows potential clients the ability to browse our product solutions, pull auto refi counts applicable to their market, and...

Not Targeting Your Members?

If You Don’t Target Your Members, Other Financial Institutions Will. Credit Union Members are Vulnerable In a recent edition of Stellar Insights, we discussed how a comprehensive growth strategy requires both an offensive and defensive approach. Member retention is...

Case Study | $1B Asset Southwest Credit Union

Background Th is southwest credit union (CU) has an asset size of roughly $1.0B with 80,000 plus members. Th e CU has a community charter footprint with a potential membership of over several million households. Th e CU rates for A, B, C, D, & E paper of 3.49%,...

Press Release: New Name, Same Stellar Company

ANNAPOLIS, MD — Feb. 22, 2022 — Stellar Auto Loans kicks off the new year by officially becoming The Stellar Financial Group.Managing Partner, Craig Simmers, states “The change was precipitated by the additional solutions we will be offering to our clients going...

Customer Acquisition | Requires an Offense and a Defense

A Comprehensive Approach Requires an Offense and a Defense Traditionally, customer or member acquisition was related to securing checking account customers. While that’s still a large component of customer acquisition strategies, it’s still only one of the proven...

The Overdraft Fee Dilemma & Solution

Understanding the Overdraft Fee Dilemma As overdraft fee concerns increase throughout the banking industry and Congress, let’s take a look at how we got here. If we go back to the period in the early 2000s, a cottage industry began to provide and manage several...

The Stellar Market Analysis Portal is LIVE

Browse Our Product Solutions at Your Convenience We are very excited to launch The Stellar Market Analysis Portal. This virtual marketing site allows potential clients the ability to browse our product solutions, pull auto refi counts applicable to their market, and...

Welcome to the Winter 2022 Edition of Stellar Insights

Welcome to the 2022 Winter Edition of Stellar Insights! As we kick off a new year, we have some very exciting news to share! The last two years have been a period of explosive growth for our company. As a result, we have invested heavily in technology and the...

Introducing The Stellar Market Analysis Portal

The Stellar Market Analysis Portal will be RELEASED THIS FALL! Once the portal is live, just go to MarketAnalysisPortal.com. There will be a simple sign-in process, as the portal is password protected.Browse Our Product Solutions at Your Convenience We are very...

A Missed-Understood Opportunity

Throughout our 20+ years in business we consistently hear the question, “What’s New?” from our clients and potential prospects. For many years there really wasn’t much that I would categorize as “New”. The growth of neobanks and the Covid-19 pandemic have in our...

Welcome to the Fall 2021 Edition of Stellar Insights

Welcome to the 2021 Fall Edition of Stellar Insights!As we enter the final quarter of 2021, our focus shifts to what we have accomplished this year, how the market has changed, and what we should focus on in the upcoming year. I am sure all of you are going through...

How Vulnerable is Your Auto Loan Portfolio?

How Much of Your Portfolio is "Indirect"? According to the NCUA, credit unions have acquired a significant portion of their auto loan portfolio from indirect loans. There’s over $1.3 trillion dollars worth of auto loans borrowed by consumers across the country, with...

Deposit Heavy? Rebalance your Portfolio with NO RISK!

Most credit unions are flush with deposits and need to deploy these funds through creative loan production. Used car sales and prices are exploding and consumers are benefiting from their vehicles not depreciating in value. Credit unions are more likely to refinance...

Overdraft and Debit Card Interchange Fees: One Big Concern, One Giant Opportunity

Overdraft under fire, now what? We are all well aware of the issues related to overdraft fees. While there are clear advantages for the consumer to have access to overdraft their account, the service has been under heavy fire from government officials and consumer...

Welcome to the Summer 2021 Edition of Stellar Insights

Welcome to the 2021 Summer Edition of Stellar Insights!Welcome to the Summer 2021 Edition of Stellar Insights. Now that the pandemic is winding down, many companies in our industry are challenged with making up for lost time. This won’t happen overnight. Although, I...

Customer Acquisition: The Immediate Opportunities

In 2000, Stellar Strategic Group was founded to assist banks and credit unions acquire new checking customers with the goal of driving low-cost core deposits. Today, I feel somewhat conflicted given the market that exists 20 years later. For the bulk of the time we’ve...

Is Your Credit Union Adapting to the “New Normal”?

The country is reopening in ways many of us have been eagerly waiting for since the spring of 2020. Many credit unions are realizing the elusive return to “normal” is nothing more than a fantasy. The tangible impact of the pandemic is forcing most to reevaluate their...

What Can Credit Unions Do NOW to Benefit from Soaring Used Vehicle Pricing?

We have all seen the news. The pandemic has disrupted the supply chains for many lines of business this past year. One such line of business is new automobile manufacturing. Today’s new vehicles use many of the same semiconductor chips that are used in other...

How Can Credit Unions Grow Their Auto Loan Portfolio During Pandemic Times?

Most credit unions have made changes to their field of membership in recent years, to help consumers in their market financially. Many have been approved to expand their footprint through community charters, to help serve the underserved, or have developed association...

Flush with Deposits, Probably. Flush with new Customers, Never!

Over the past 20 years of working with community banks and credit unions, we have witnessed first-hand how high-performing institutions adapt to improve their marketing efforts. The #1 trait these institutions have is a persistency and commitment to executing...

Q&A: Stellar Auto Loans Recapture Program

What you need to know about the Stellar Auto Loan Recapture Program Over the years, we've had many people ask us: “How does Stellar's Auto Loan Recapture Program work?” For this article, we have compiled a list of questions and answers about our direct auto loan...

Stellar Insights Spring 2021

Welcome to the 2021 Spring Edition of Stellar Insights!Welcome to the Spring Edition of Stellar Insights. As I looked back at previous editions, I was struck by my comments related to where we were at that time related to the pandemic. I’m happy to say that this...

Stellar Insights Winter 2021

Welcome to the 2021 Winter Edition of Stellar Insights!As we start the new year, we find ourselves still dealing with uncertainty due to the pandemic. I think we were all hoping by this time we would be getting back to a sense of normalcy. That’s the bad news. The...

FEATURED ARTICLE FROM GREGG STOCKDALE

NEVER Turn Off Demand!Many credit unions are struggling to achieve a 50% loan to share ratio. Some of those have used indirect or purchased loan participations to enhance their loan/share ratio. Then there’s the credit union which has found a strong loan demand…even...

FEATURED ARTICLE FROM LISA BUNDY

Auto Participations are HOT, HOT, HOT!!!Why? Well, several reasons. One has to do with the demand that is being driven by the high liquidity of most financial institutions and the hunt for low-risk assets that yield a decent premium. Auto loans have been a great...

HOT New Member Acquisition Strategy

The case for a more balanced auto loan approach. STELLAR AUTO LOANS SUCCESS FEE-BASED AUTO REFINANCING PROGRAM PROVIDES REAL MEMBERSHIP GROWTH THAT IS EXTREMELY PROFITABLE TO THE CREDIT UNION.New Member Growth Strategies Most credit unions are typically looking for...

FEATURED ARTICLE FROM BRIAN JONES

THE QUESTION WE HAD TO ANSWER EARLY ON WAS “HOW CAN WE BECOME FASTER, BETTER, AND MORE EFFICIENT, WHILE PROVIDING A BETTER CUSTOMER EXPERIENCE?”Gravity Lending set out to offer a vast array of consumer lending products, connecting consumers to lenders for the lowest...

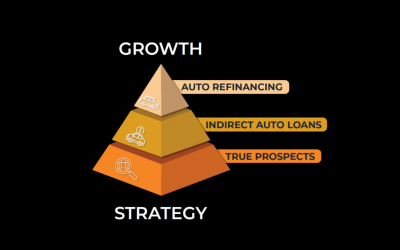

The Stellar Growth Approach

The Stellar Growth Approach The three pillars for defining your financial growth strategy Program Commitments are not a Growth Strategy Stellar has had the opportunity of working with thousands of community banking institutions over the past 20 years. After all these...

Welcome to Stellar Curt Belaney!

We would like to take this opportunity to welcome our new regional sale's director, Curt Belaney! Curt has a strong background in the auto refinance realm and will be an important addition to our team. The following is a message from Curt to all our clients,...

First SALcares Campaign with OECU

Lending a Helping Hand With OECU Our first SALcares campaign has launched with Oklahoma Educators Credit Union (OECU). The SALcares program is Stellar’s effort to support local nonprofit organizations our clients serve. OECU selected six charities/nonprofit...

Notification Mailing Services

Over the past 20 years of executing marketing campaigns for our bank and credit union clients, we have been asked to execute numerous other types of mailing campaigns. In particular, over the past 18 years we have performed over 7,000 overdraft notification compliance...

Stellar Insights Fall 2020 Intro

From Our Founder Oh, what a year! I’m sure we can all agree that 2020 is a year we’ll never forget. We hope you, your colleagues, and family have weathered the storm in good health. As we developed this edition of Stellar Insights, we decided to focus on content that...

Seize The Growing Auto Refinance Opportunities

The last few quarters of the 2020 pandemic have changed consumer behavior. Businesses have had to cope with many barriers to business as usual, with closures, social distancing, reduced foot traffic, etc. Consumers are faced with both family health and financial...

The Checking Account Goldmine

The rapidly increasing value of a checking account has never been greater than it is today. In my 20 years of assisting clients with growing their checking and core deposit base, we have never seen the value of a checking as high as it is today. We have always...

Introducing SALcares

Introduction Since the start of the COVID-19 pandemic, we’ve all seen numerous restaurants, retail stores, and other small and large businesses suffer financially or ultimately close. However, it has almost gone unnoticed that nonprofit organizations are really...

Stellar Auto Loans Announces Partnership with Gravity Lending

This strategic partnership will deliver an expanded suite of products and services to their credit union lending partners.Press release Annapolis, Maryland – Stellar Auto Loans continues to expand its product line with their partnership with Gravity Lending, based in...

Overdraft Compliance Notifications

Since 2000, Stellar Strategic Group has assisted over 1,400 institutions with executing overdraft notification campaigns, in a timely and cost-efficient manner. Our goal is to produce maximum results for your overdraft program. Compliance Notifications Made Easier...

Auto Loan Recapture Best Practices

We have all seen the studies. Most consumers are living from paycheck to paycheck. Since the Great Recession, the median income has fallen by 13% from 2004 levels, while expenditures have increased by nearly 14%. In another recent study, it was determined that nearly...

Welcome to our Summer 2020 Edition of Stellar Insights!

Introduction Welcome to our summer edition of “Stellar Insights”. As I sat down to write this introduction I was struck with the thought: where to begin. This year started off with such great promise and quickly turned into something no one could’ve predicted....

The Value of a Direct Auto Loan

Overview Most institutions understand the need to grow organically and provide a stable membership base. Members that use a credit union as their Primary Financial Institution (PFI) generate dependable assets and deposits for planned future growth. Typically, the more...

The Indirect Auto Loan Opportunity

Credit Unions have been helping members finance vehicles since they were first established. Over many decades CUs have grown their indirect auto loan portfolio with aggressive rates and technological upgrades through dealership financing relationships. Unfortunately,...

The Indirect Dilemma

Indirect Auto Loans Have Created a Direct Dilemma The indirect auto loan source has historically been a dilemma for bankers of financial institutions. The good news is that it provides a relatively steady source of loans. They increase the assets of an institution...

Is Your Auto Loan Portfolio Well Balanced?

Credit Unions have been helping members finance vehicles ever since they were first established. Over many decades, CU’s have grown their indirect auto loan portfolio with aggressive rates and technology upgrades through dealership financing relationships....

Welcome to our Spring 2020 Edition of Stellar Insights!

Introduction This year COVID-19 has taken a major toll on most families and businesses. During these uncertain times, we’ve had to adapt our business models and our lives in order to survive. I’m confident that soon after this is over, we’ll all be back better than...

“Too Big to Fail” and “Too Big to Service”

The Big Banks are Vulnerable We’ve all heard the phrase “too big to fail” related to the big banks. I firmly believe the past twelve years have proven they’re actually “too big to service” the bulk of consumers. Clearly, big banks play a major role in our economy. But...

Do you generate more “Loaners” than “Lifers”?

Every credit union understands the need to keep more assets on the balance sheets. Profitable loans are the lifeblood for all banking institutions. All asset managers understand the principle of generating interest income. But it is not as simple as monitoring the...

Stellar Thoughts: When it Comes to Marketing, Persistence is Key.

Dedication Leads to Success Over the past 20 years of working with community banks and credit unions, we have witnessed first-hand how high-performing institutions strategize to improve their marketing efforts. As simple as it sounds, the number one trait all these...

How to Serve the “Underserved”

Most credit unions started “life” as a SEG based institution. Many were designed to meet the banking needs specific businesses employees by financing loans, open savings accounts, and even transactional accounts through payroll deductions. 80% of all auto loans are...

Case Study: New Strategies to Grow Core Deposits.

Background: This 10-branch, community bank in the southeast currently has $709 million in assets. Stellar Strategic Group originally partnered with this financial institution in 2011 to help grow core deposits. Recently, we wanted to ramp up results for this client...

Increase Brand Awareness with No Marketing Cost

How can you Increase Brand Awareness? Many credit unions advertise through multiple mediums to try to measure “brand impression rates”. The goal is that with increased brand recognition and traffic your sales will grow in markets with increased impression rates. The...

A Special Message Regarding COVID-19

A SPECIAL MESSAGE FROM OUR FOUNDING PARTNER Dear Colleague, The COVID-19 Virus is disrupting many of the services that were part of “business as usual.” Dealerships are reporting a significant downturn in sales. Indirect loans are reaching new lows. Consumers are...

Loan to Deposit Ratios Peaking

Using Active Marketing to Combat High Deposit Ratios During our monthly analysis of loan to deposit ratios nationwide we looked at the ten highest ratios in each state among banks. To our surprise the average ratio was 109.5%. As we all know, there was a period from...

How to Maximize Your Community Charter

Targeting New Members Most credit unions that have successfully gained charter approval from the NCUA have done so by providing banking to “help serve the underserved” in a specific geographic area. The Community Charter effectively makes the neighbors of your current...

Direct vs. Indirect Auto Loan Profitability

Credit Unions have helped members finance vehicles since the first credit union was established. Over many decades, CU’s have grown their indirect auto loan portfolio by leaps and bounds, with aggressive rates and technology upgrades through dealership financing...

Attrition: Culprit or Opportunity?

Sharing our Experience Almost 20 years ago, I walked away from a career in the newspaper industry and started Stellar Strategic Group. Having no formal training in the banking industry this pivot in careers seemed odd to many of my co-workers and friends. My theory...

Case Study: $160MM Asset Credit Union

Background: This credit union (CU) is located in the Southwest and has an asset size of roughly $160MM with 14,000 plus members. The CU has a community charter footprint with a potential membership of 500K plus. The CU was not the market leader in rates, with rates...

Case Study: $1.3B Asset Credit Union

Background: This credit union (CU) is located in the Midwest and has an asset size of roughly $1.3B with 120,000 plus members. The CU has a community charter footprint with a potential membership of over several million households. The CU rates for A, B, C, D, & E...

Finding the Optimal Multi-Channel Marketing Approach to Grow Your Primary Deposit Accounts in 2020

In today’s banking world, multi-channel marketing isn’t just a buzzword anymore — it’s a necessity for marketing success. Banking is moving from in-branch to on-device, and your marketing efforts should reflect that shift. People are utilizing more devices daily with...

How to Develop a Successful Auto Lending Strategy for 2020 Considering Tomorrow’s Tighter Margin Environment

How great would it be to have a crystal ball that accurately predicts the future? What might it foresee when it comes to strategic planning and budgeting for auto lending in 2020? Available on the market are a myriad of “future analytic” programs that predict...

Welcome to our Spring 2019 Edition of Stellar Insights!

As summer quickly approaches, we thought focusing on immediate opportunities would be most beneficial for this edition of Stellar Insights. It's common this time of year to analyze "where we are" versus "where we want to be" and make any necessary adjustments to...

Introducing SALrefi – A New Online Direct Auto Loan Source for Our Lending Partners

SALrefi.com is an innovative, consumer-facing web platform. This free online service helps consumers find the best auto refinance option in their market. We're off and running with our new online auto-refi lead source - SALrefi.com. We initially wondered how...

Interest Income is Interest Income, Right?

The brutal reality to the question above is: "It depends on the cost of acquisition, and any lost opportunities." Auto loans are the "lifeblood" for most credit unions needing assets. When credit unions were first formed, most were SEG based, trying to help members of...

Frequently Asked Questions: Growing Deposit Market Share in 2019

Year after year, we receive numerous questions about best practices when it comes to growing retail deposit market share. Specifically, about establishing the Primary Financial Institution (PFI) status via checking account relationships. An interesting fact: The...

Welcome to our Summer 2018 Edition of Stellar Insights!

Given the timing of this edition of Stellar Insights, we decided to focus on issues that may be helpful as you start thinking about strategic planning for the upcoming budgeting season. It will be here before you know it! The articles in this edition are based on...

Today’s Market for Driving Low-Cost Core Deposits

Over the last 18 years of working with community banking institutions, we have not experienced a better market to drive low-cost core deposits than we have today. Yet, it is surprising to me how few are taking advantage of this opportunity. There are numerous factors...

Are You Maximizing Your New Membership Potential?

Credit unions are in the business of educating. Much of that education is centered around the advantages and benefits of credit union membership as well as adopting strategies to help serve the underserved in their market. Relying on traditional SEG-based growth in...

Welcome to our Spring 2018 Edition of Stellar Insights!

Let me start by wishing everyone a Happy & Prosperous 2018. This edition of Stellar Insights focuses on the trends and opportunities we have seen while servicing our client base. We touch on a varied list of issues that have become very topical in recent months....

Direct Versus Indirect Lending: Balancing Your Credit Union’s Auto Loan Portfolio

Auto lending has increasingly become a profit center for the credit union industry over the years. Most credit unions offer some type of auto loan financing whether directly to their members or through auto dealerships and other relationships. In this article, I will...

Stellar Strategic Spotlight: Mortgage Analytics

In previous editions of Stellar Insights, we chronicled the pitfalls and opportunities of customer attrition. One area that most institutions tend to ignore (that is both a contributor to attrition and a selling opportunity) is targeting current clients for mortgage...

Three Ways to Create Superstars with Your Frontline Staff:

Lessons Learned While Mystery Shopping I consider myself lucky. Over the years, I have accrued wonderful memories and great experiences while mystery shopping at bank and credit union branch locations across the United States. A few stand-out memories pop into my...

Fintech Made Easy: Where to Begin for Community Banking Professionals

Fintech, Blockchain, Neo-Bank, Digital Disruption. These topics have increasingly become commonplace in the banking industry. You want to better understand these concepts, so you Google and find numerous articles on the subject matter. After researching, you can't...

Welcome to our Fall 2017 Edition of Stellar Insights!

I'm particularly excited about this edition because it features two guest contributors, both current clients of ours. When we requested their input, we were asked, "Am I supposed to say something nice about Stellar?" As you will see by the content of their articles,...

Eight Key Steps to Growing Retail Deposit Market Share

In October of 2015, we began what has become a multi-year process of addressing issues related to growing deposit market share. When Craig Simmers, Founder of Stellar Strategic Group, asked me to share some of our experiences during the past two years, I knew this was...

Attrition…Controllable or Uncontrollable?

How to Manage Your Opportunity to Reduce Controllable Attrition Rates In an earlier edition of Stellar Insights, I discussed at length the effects of attrition on growing retail market share. One issue I addressed was the importance of identifying product-specific...

Take Time to Think Outside the Box: How Bank Marketers Can Move the Marketing Needle

As marketers, one of the biggest challenges we face is how to devote proper time and resources for the development and testing of new marketing ideas. Sometimes it’s just easier and more convenient to run the same successful campaign year after year instead of...

Future Insights: 2018 Marketing Predictions for the Banking Industry

Prediction #1 - Competition for Core Deposits will get Tougher Over the last few years, focus on growing core deposits waned at many community banks and credit unions. Those institutions that consistently marketed for deposit accounts during this time found easy...

Welcome to our Summer 2017 Edition of Stellar Insights!

If you are a new subscriber...let me take this opportunity to welcome you and share why we decided it was important to publish a quarterly newsletter. Over the past 17 years, we’ve accumulated an enormous amount of information and developed best practices in...

Frequently Asked Questions on Growing Deposit Market Share

For nearly two decades, we have fielded numerous questions about best practices on how to grow retail deposit market share, specifically in regards to establishing primary banking relationships. An interesting fact...the questions haven't changed much over these...

Mobile is the New King for Google Search: What Does This Mean for Your Financial Institution?

It has finally happened. The almighty desktop computer has been dethroned and surpassed by mobile devices for Google searches. This should not come as a surprise, as the install base for mobile devices is greater than desktop computers in 2017. What you may not know...

Catching the Summertime Auto Loan Opportunity

One question I hear frequently from financial executives this time of year is the following: Why spend marketing dollars on new or used auto loans in the summer since these are the peak months for auto loans anyway? This question is a good one, especially considering...

Attrition…A Silent Killer to Growth

During the 20+ years I spent in the newspaper industry, customer attrition was a metric that was constantly monitored and managed. In fact, it played a major role in establishing marketing plans and budgets. Unfortunately, that is not always the case in the banking...

Welcome to Our Inaugural Edition of Stellar Insights

Over the past 17 years, we have been fortunate to have worked with over 1,600 banking institutions and accumulated a wealth of information related to best practices - as well as how high-performance institutions achieve success in certain areas. This newsletter is our...

Is Your Website ADA Compliant?

In the 4th quarter of 2016, an alarming number of financial institutions started to receive legal demand letters for non-compliance with the WCAG 2.0 (Level AA) Web Content Accessibility Guidelines from the World Wide Web Consortium (W3C). The W3C set the standards...

Community Banks and Credit Unions are Out-Performing National Averages in…Digital Marketing?

Impossible you say? On the surface, I agree it seems counterintuitive. Think of the budgets, the resources, and the manpower that big national companies have ready at their fingertips. Bank of America, for instance, is estimated to have a marketing budget over $2...

Auto Loan Recapture Best Practices

We have all seen the studies. Most consumers are living from paycheck to paycheck. Since the Great Recession, median income has fallen by 13% from 2004 levels, while expenditures have increased by nearly 14%. 1 In another recent study, it was determined that almost...