We have all seen the news.

The pandemic has disrupted the supply chains for many lines of business this past year. One such line of business is new automobile manufacturing.

Today’s new vehicles use many of the same semiconductor chips that are used in other products, such as mobile phones, computers, etc. Chip manufacturers worldwide have reduced production during this viral epidemic, and do not expect to meet the demand for many months yet to come.

Consequently, the number of new vehicles for sale at dealerships fell 36% in March, compared with a year earlier, according to Edmunds Used Vehicles. In addition, demand for vehicles has increased as consumers are looking for vehicles to avoid public transportation or ride sharing because of the virus.

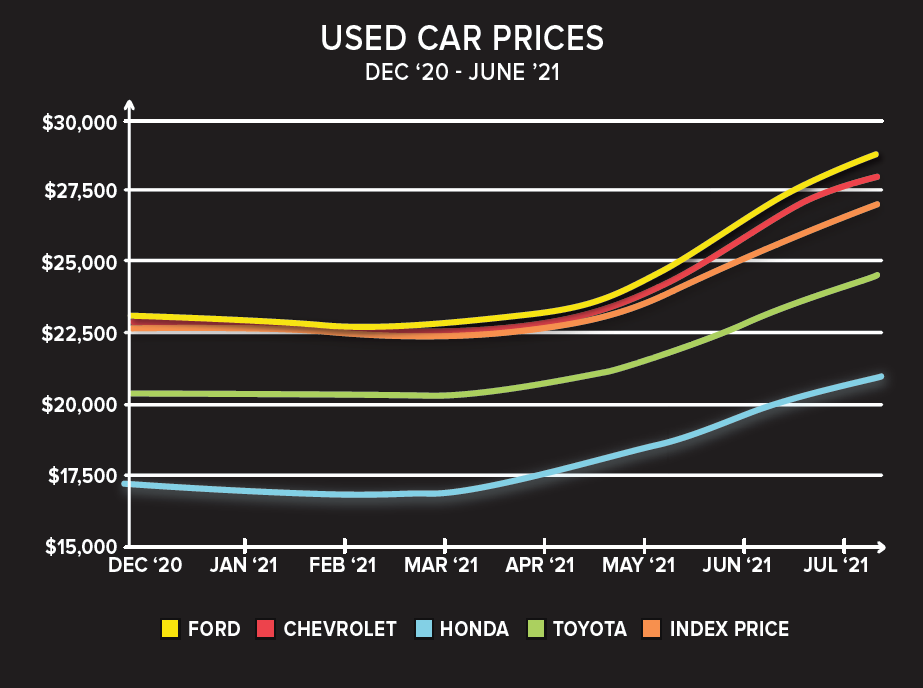

With this shortage of new vehicles, used vehicle sales and prices have exploded! The average list price for used cars in March reached $21,343, up more than $2,000 from a year earlier, according to COX Automotive, which owns Kelley Blue Book and Autotrader.

Consumers are enjoying the benefit of their current vehicles not depreciating in value, as they make their monthly auto payments. They become more attractive for credit unions to refinance that potential member, since the loan to value has mitigated substantially. Whereas the consumer might have been far “upside-down”, they are now well within LTV credit parameters.

Savvy credit unions know this is the time to step up their auto loan refinancing programs. Not only to current members that have auto loans with other institutions and captives, but also new potential members that reside in the credit unions community charter of special association.

How do you find these qualified potential members that can save significantly by refinancing with your institution for a lower rate?

One way is to use the Stellar Auto Loan Recapture Program, which is quickly becoming the most profitable member acquisition strategy available today, producing instant revenue generating members that retain long-term.

Stellar Auto Loans pays for all the up-front costs to solicit to new potential refinance members that reside in your charter footprint, and you pay only for the loans you actually refinance.

You pay nothing out of pocket until the new member responds. You start with a pre-qualified list of potential members from your pre-defined zip-codes utilizing your pre-defined credit criteria. Our multiple response mechanisms ensure great response rates. (Direct mail, telemarketing, online application sites, digital marketing, and reminder mailing). Applications are submitted to the lending team, to decide to approve or deny the loan. Our proprietary credit bureau selection process generates an average look-to-book rate of around 50%.

Please visit us at https://www.thestellarfinancialgroup.com/free-customized-market-analysis/, to get a free analysis of the opportunity we see in your specific market.

George Monnier is a founding partner of Stellar Auto Loans, a division of Stellar Strategic Group, which offers pay-for-performance auto refinance programs to the banking industry. Contact him at george.monnier@stellarautoloans.com or 402-708-2425.